Wednesday, March 10th 2021

Prices of Client SSDs for Notebook Computers to Enter Early Uptrend in 2Q21 with 3-8% Increase QoQ, Says TrendForce

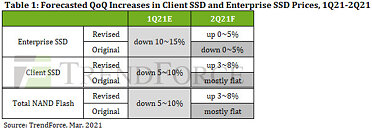

Demand for notebook computers is expected to remain strong throughout 2Q21 due to the persisting stay-at-home economy that arose in the wake of the pandemic, according to TrendForce's latest investigations. In response to the high demand for notebooks, PC OEMs are actively raising a consistent inventory of components, including client SSDs. Nonetheless, client SSDs are now in increasingly tight supply because the preexisting shortage of NAND Flash controllers is now exacerbated by the power outage at Samsung's Austin-based semiconductor plant. SSD manufacturers are therefore preparing to raise the prices of SSDs. Accordingly, TrendForce has also revised up its forecast of client SSD prices for 2Q21 from "mostly flat" to a 3-8% increase QoQ instead.As previously mentioned, Samsung's semiconductor plant in Austin, Texas (here referred as Samsung Austin) was affected operationally by a severe winter storm that blanketed the entire state last month. As a result, production activities at the plant were mostly suspended from mid-February to March 2. TrendForce's investigation of this incident finds that the plant is starting to recover operationally. Even so, the capacity utilization rate of the whole plant is not expected to return to the level of above 90% until the end of March, and this delay has had a palpable impact on Samsung's chip production. With regards to product mix, there is no wafer input for NAND Flash at Samsung Austin. Nevertheless, 10% of its production capacity is used to manufacture in-house controller ICs for Samsung's own branded SSDs. TrendForce's investigation also finds that most controller ICs made at Samsung Austin are for client SSDs shipped to PC OEMs. In particular, among Samsung's client SSD offerings, products based on 128L NAND Flash are expected to be directly affected by the incident.

It should be pointed out that, after kicking off mass production of 128L client SSDs in 4Q20, Samsung originally planned to take advantage of the release of Intel's Tiger Lake CPUs to expand Samsung's market share of PCIe G4 SSDs through aggressive pricing. After all, its competitors have been slow in ramping up production of PCIe G4 SSDs due to the negative impact of the pandemic and due to the longer-than-expected qualification process from PC OEMs. In light of the shortage of controller ICs, however, all SSD manufacturers are now forced to extend the lead times for their SSD orders, making it difficult for any manufacturer to increase their supply of SSDs and compelling them to in turn raise 2Q21 prices of client SSDs.

On the other hand, the power outage has had an impact on enterprise SSD prices as well, since enterprise SSDs and client SSDs are highly correlated in terms of prices. Furthermore, clients in the data center segment are expected to ramp up their procurement activities for enterprise SSDs in 2Q21 after the previous bearish period, meaning there will likely be successive QoQ increases in the volume of enterprise SSD orders going forward. Enterprise SSD prices are therefore expected to enter an impending upturn, and TrendForce has in turn revised up its forecast of enterprise SSD prices for 2Q21 from a 0-5% decrease QoQ to a 0-5% increase QoQ instead.

It should be pointed out that, after kicking off mass production of 128L client SSDs in 4Q20, Samsung originally planned to take advantage of the release of Intel's Tiger Lake CPUs to expand Samsung's market share of PCIe G4 SSDs through aggressive pricing. After all, its competitors have been slow in ramping up production of PCIe G4 SSDs due to the negative impact of the pandemic and due to the longer-than-expected qualification process from PC OEMs. In light of the shortage of controller ICs, however, all SSD manufacturers are now forced to extend the lead times for their SSD orders, making it difficult for any manufacturer to increase their supply of SSDs and compelling them to in turn raise 2Q21 prices of client SSDs.

On the other hand, the power outage has had an impact on enterprise SSD prices as well, since enterprise SSDs and client SSDs are highly correlated in terms of prices. Furthermore, clients in the data center segment are expected to ramp up their procurement activities for enterprise SSDs in 2Q21 after the previous bearish period, meaning there will likely be successive QoQ increases in the volume of enterprise SSD orders going forward. Enterprise SSD prices are therefore expected to enter an impending upturn, and TrendForce has in turn revised up its forecast of enterprise SSD prices for 2Q21 from a 0-5% decrease QoQ to a 0-5% increase QoQ instead.

4 Comments on Prices of Client SSDs for Notebook Computers to Enter Early Uptrend in 2Q21 with 3-8% Increase QoQ, Says TrendForce